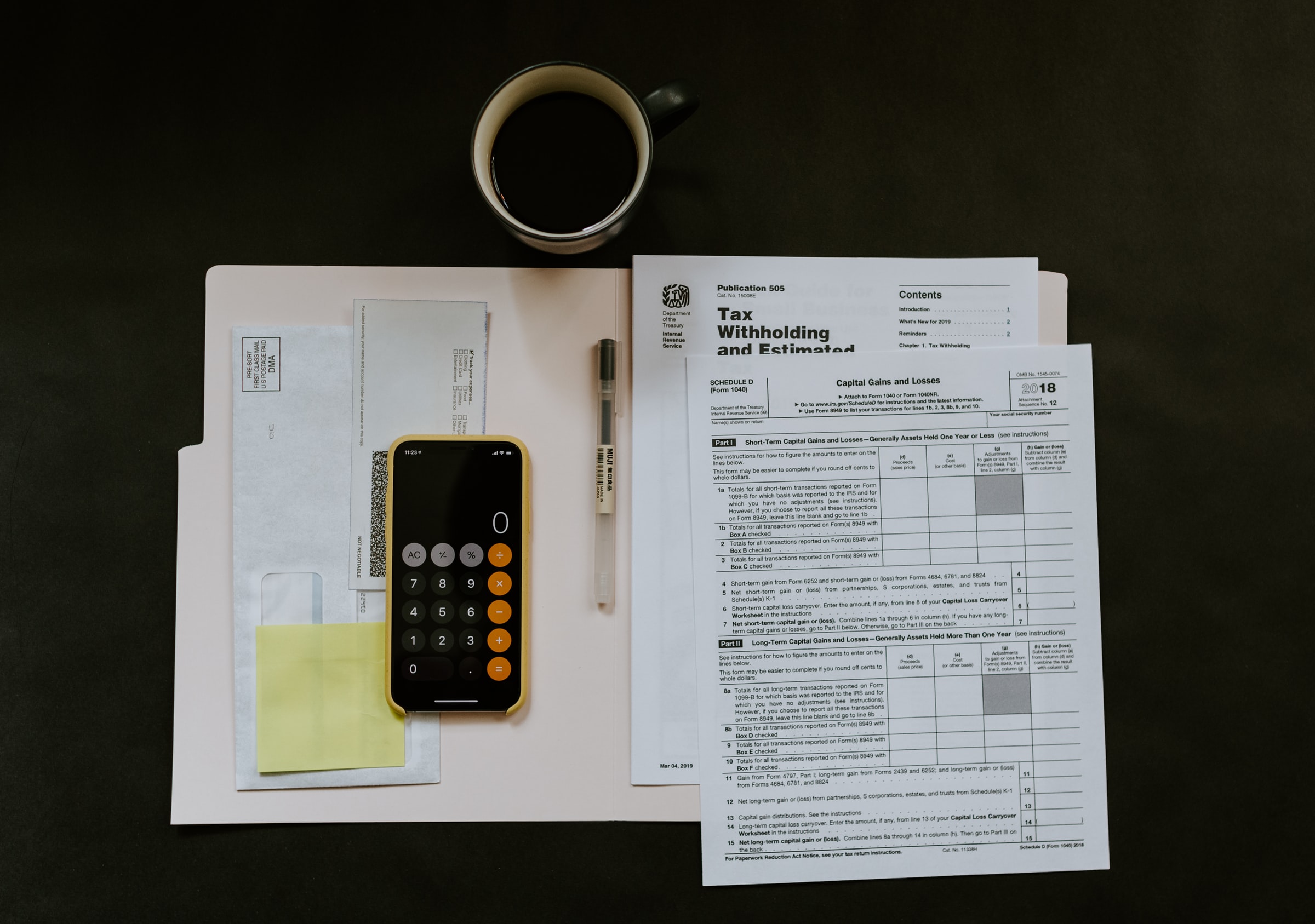

Streamline Your Finances with Expert Help!

Small businesses are the backbone of the Hampton Park economy, offering unique products and services while creating employment opportunities. However, managing the financial aspects of a business can be daunting, especially for new entrepreneurs. From bookkeeping to payroll, and BAS lodgement to superannuation, understanding the intricacies of small business accounting and administration is crucial for […]