Accounting is a fundamental part of businesses. Even though accounting mistakes can happen occasionally, but wouldn’t it be better if you could avoid some common mistakes? Here’s a list of some accounting mistakes that you can avoid with proper planning and preparation.

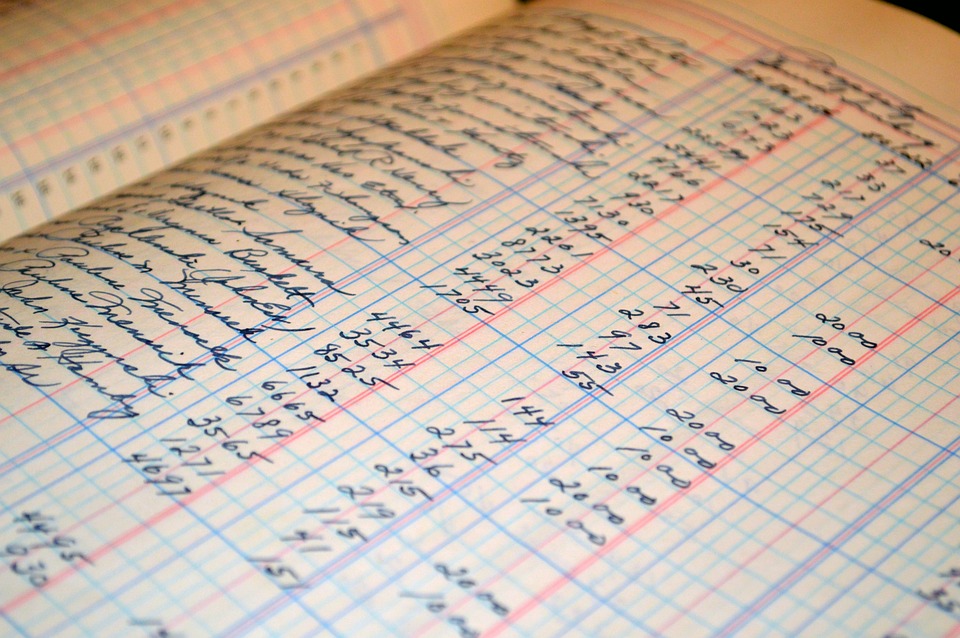

#1. Lack of Organization

Do I really need to mention how accounting requires excellent organization skills?

As an accountant, you will have to record every single transaction, store (or now digitize) receipts for future use, calculate taxes and so on. However, if these pieces of information are not stored properly, it is obvious then that you might miss a crucial transaction or lose an important receipt. And, what happens when the tax season comes? You could get in deep trouble, obviously!

#2.Not Following Bookkeeping Procedures

Nowadays, it is recommended that even small enterprises, self-employed persons and freelancers should make use of formal, detailed and documented methods to manage accounting procedures and also to perform other routine tasks.

One effective procedure is to set up standardized forms and checklists to complete so as to ensure consistency and accuracy.

Let me give you a simple example: You can put up a process for setting up new vendors and for that you will need the vendor’s name, address, telephone number and Employee Identification Number (EIN) and other crucial documents such as insurance certificates, letters of recommendation and signed contracts might be required. And, after entering these pieces of information into your accounting system, payments can be processed.

Remember that it will cost you a significant amount of time to develop such a standardized form or checklist as you will have to gather information from your vendors and then have a sort of written policy for your employees to follow.

#3. Failing To Be Accounting Software Shrewd

Did you know that in the rush of setting up a business, many business owners do not get enough time to correctly learn the accounting software that they have chosen to use?

And, of course, when you don’t know what an accounting software is capable of doing, it is evident that you would make some mistakes or miss out on some vital functionality. Additionally, some incomplete or wrong information can lead to bad business choices.

#4. Mixing Professional and Personal Finances

By mixing your business and personal finances, you are making one of the most common accounting mistakes that most business owners make. Therefore, it is essential to keep them separate and to keep a detailed track record of what really happened in your business and what is specifically related to your personal use only.

#5. Throwing Away Receipts

Receipts still count today and even though they have become digitalized, there are some specific cases where they need to be recollected as they can provide solutions to mistakes or fill the gaps in bookkeeping records. Besides, during tax time, receipts can provide additional deduction opportunities.

#6. Making Maths Mistakes

I often wonder who are those weird people who love mathematics (apart from mathematicians, of course).

Let me tell you that despite using automated accounting solutions, many people often tend to make maths mistakes (especially when they are in haste to get the job done after a long tiring day). But, remember that these mistakes (even if they arose from typos) can prove to be very costly.

#7. Failing To Reconcile Accounts

Reconciling is a critical process that involves checking an account balance as recorded on your books is correct and accurate and ensuring that it matches the actual bank account balance. And, if there is a gap between the two accounts, this means that there is an error and if you want to prevent this small issue from worsening, you need to give immediate attention to this problem. Moreover, if you review and reconcile your business bank accounts on a regular basis, it will help you to catch any fraudulent transactions that may have occurred within the organization.

#8. Not Backing up Data

How would you feel if the device on which you stored all your business’s financial information was hacked or stolen? And, worse: what if you didn’t have it backed up at all?

Well, this issue often happens with many accountants who feel as if their lives have been turned upside down. However, good news is that there are some pretty good backup options available nowadays that can save you from this crisis.

Will you follow these tips? Please share your comments!